How to Maximize Outcomes Today and in Six Months

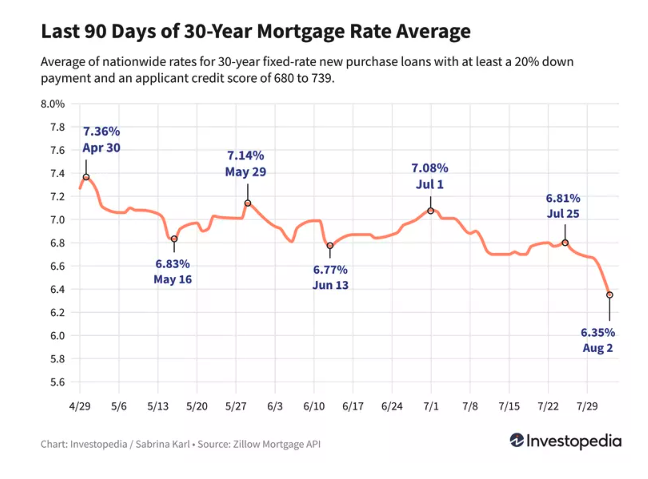

In great news for house-shoppers, house owners, and mortgage companies, average 30-year mortgage rates just dropped to their lowest level in over a year. As of early August, 30-year mortgage rates stood at 6.125%.

This “means better pricing to consumers, incentivizing them to take advantage of approximately half a percentage point in rate improvement in the market” – Rick Roque, executive vice president of retail, Sierra Pacific Mortgage

As you can surely guess, people are jumping on the opportunity to start home shopping again and getting ready to refinance their homes. For mortgage companies, it’s game time.

In light of this opportunity, mortgage companies must boost marketing efforts as well as re-engagement strategies in order to be first in front of homeowners who are ready to refinance.

Let’s talk about the significance of these changes to mortgage rates and five essential re-engagement strategies to help mortgage companies make the most of this golden opportunity.

What Mortgage Rates Dropping Means for Mortgage Marketing

In 2022 and 2023, the Fed increased rates at historic speed and extent—meaning mortgage rates experienced a huge increase over the last two years.

This increase was not easy for mortgage companies, many of which have struggled while waiting for rates to drop again. Marketing efforts were put on pause, and for good reason.

Meanwhile, Americans have adjusted to the fact that mortgage rates aren’t 3% anymore. Similarly, anyone who bought a house in the last year or so has been waiting for the right opportunity to refinance their homes.

This month, with rates finally dropping to a new low, mortgage companies should be hitting marketing hard, engaging and re-engaging as many clients as possible.

“Mortgage rates are falling further and faster than expected… For house hunters who have been waiting for rates to fall before they buy a home: Now is the time. Mortgage rates may decline more as the year goes on, but that will invite competition and push home prices higher, likely canceling out the savings.”

– Redfin Chief Economist Daryl Fairweather

The volatility of the situation means it’s even more crucial to get your brand in front of as many people as possible—and do it fast.

After rates have been high for so long, this drop creates a point of fierce competition among mortgage companies. How can your company stand out from the rest and win more qualified customers?

The short answer: strong marketing plus fast re-engagement.

Re-engagement is very key in this situation: don’t let your marketing dollars be wasted on squandered opportunities.

Now is the perfect time to engage live leads and older customers. People who are familiar with your brand (or even better, got a quote from your company), are much more likely to purchase from you now or in the future.

Here are five dos (and don’ts) for re-engagement to help you get ahead of the competition as mortgage rates drop.

1. DO: Engage inbound leads quickly.

So you’re getting more inbound leads than you have in the last 18 months: great! Make the most of this opportunity by engaging inbound requests as soon as possible.

This goes for both new home buyers and homeowners looking to refinance. Research shows that conversion rates skyrocket by 21x when leads are engaged within the first five minutes.

If you’re not first, you’re last.

Buying a house or refinancing a home are big decisions. When you engage first and gain trust, potential customers are exponentially more likely to choose your company when they’re ready to buy—whether that’s now, or in the future.

Even if they aren’t ready to buy for another six months, when you establish trust, you can be there to help them when the time comes.

DON’T: Only engage during business hours.

Engagement should be fast—and it should happen on the customers’ time. This means that your business must be available outside of traditional hours. Why is this so important?

First, interest rates can change by the hour, day, and week. Interested people are keeping a watchful eye on these changes—and whatever day or hour they’re ready, you should be there to help.

Secondly, keep in mind: homebuyers are making a big decision that will impact the next 30 years of their life. Refinancing, too, can be a costly decision.

People make these decisions on their time. You don’t make these kinds of decisions at 3pm during your workday—people are thinking about these things on the weekend, or at 8pm when they’ve finished their day and can really think about life plans.

When you make yourself available at these times, you can reach the customer exactly where they are, when they are ready to talk.

2. DO: Publish educational content.

Educational content is a powerful tool for positioning your mortgage company as a trusted advisor. You can produce content like blog posts, videos, and data-backed white papers that explain market trends and help people make decisions on when to refinance or secure a mortgage.

This content should be easy to understand and widely accessible across all your channels, including your website, social media, and email newsletters.

By educating your audience, you help them make informed decisions, which fosters trust and strengthens your reputation as a thought leader in the industry.

DON’T: Be inconsistent.

When it comes to publishing content and positioning your company as a thought leader, consistency is key. Identify a goal for how much content your team is able to produce, and create a content calendar that helps you stay on track for both content creation and promotion.

When you publish content consistently, your audience begins to expect and look forward to your updates. This anticipation can lead to higher engagement rates as your audience actively seeks out your content.

For example, if you publish a newsletter on the first of every month, your subscribers will know to check their inboxes for it. If you suddenly stop or publish sporadically, you risk disappointing your audience and losing their interest.

3. DO: Revive aged leads.

Now is the ideal time to revive aged leads, reminding them that your company is the top choice for their mortgage needs—whether it’s refinancing or buying a new home, and whether that’s this month or six months from now.

Older customers can be a goldmine in these situations because they already know your brand, have hopefully already had a great experience, and can easily be persuaded to choose you again.

When the competition is fierce, re-engaging aged leads is crucial to nurturing connections you already have a

nd encouraging them to be a returning customer.

DON’T: Wait for them to come to you.

While customers may have heard about rate changes, or be thinking about buying a new home, they might be too busy or too indecisive to reach out. Maybe they aren’t even watching rates.

In addition, if the lead is very old, they might have forgotten about your company and start shopping around for rate quotes.

It’s up to you to remind them that you’re there, and that now is a great time to start thinking about mortgage.

Marketing can send out email or SMS blasts to ensure that people remember your brand. Sales can take initiative to send personalized messages to old clients, assuring them that your company is ready to help.

4. DO: Engage on the right channels.

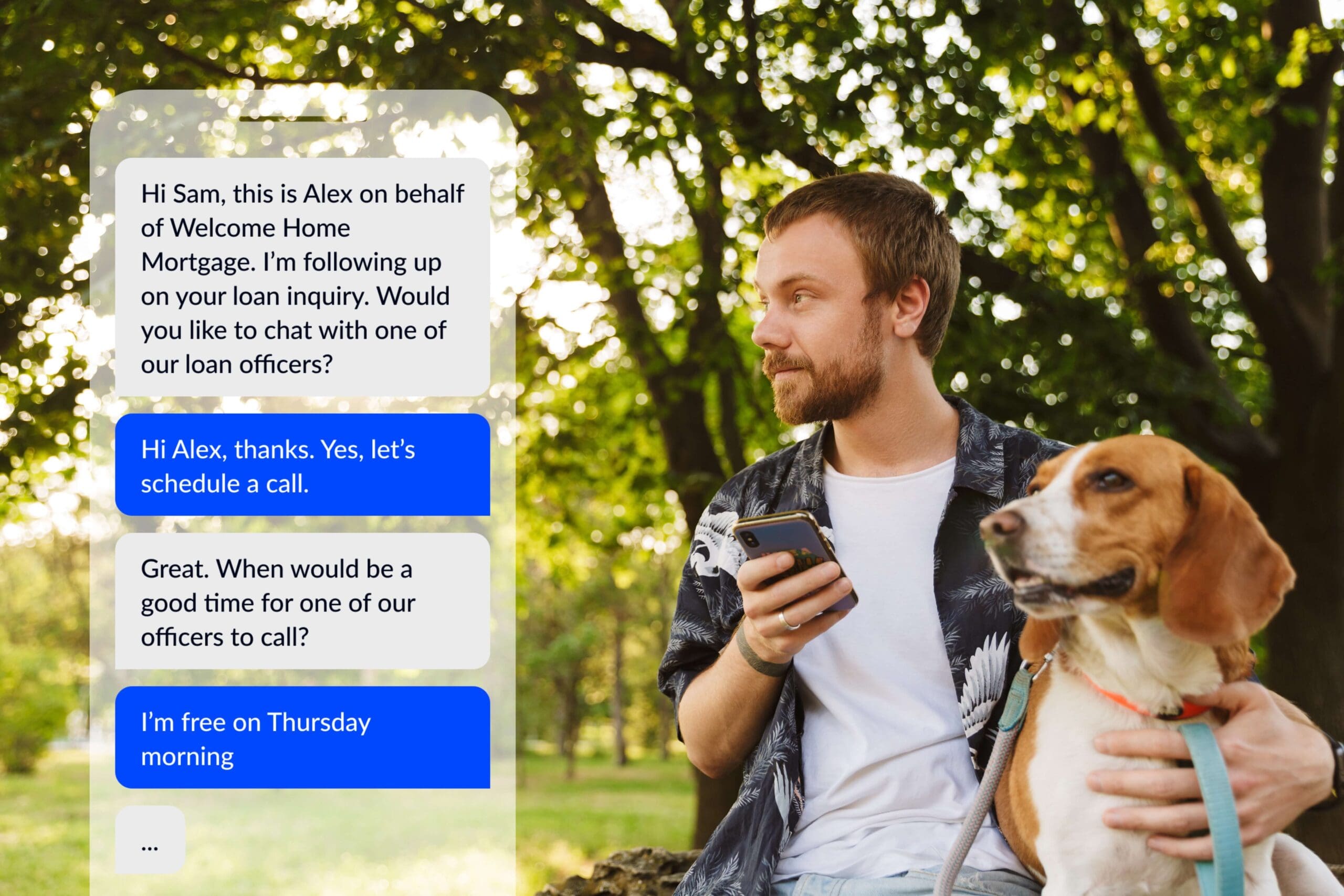

While engaging quickly is important, it’s also very critical that your messages reach prospective customers. Leverage an omnichannel approach, and be sure to include high-conversion channels for your audience.

Though some people do prefer to be called, the numbers are not in favor of simply calling. Only 13% of unknown calls are answered, and cold call conversion rates are declining, with the average being 2%.

Text is a modern choice for mortgage companies, with high conversion rates, including high read and response rates.

DON’T: Just send emails.

Though email is a top choice for many mortgage companies, people don’t read emails as much as they used to. On the other hand, people are almost certain to read and much more likely to respond to texts.

Even if people read their emails, they often don’t do it in a timely manner. As we’ve talked about, speed is key, and texting is a great way to get in front of people quickly, with people checking their phones an average of 144 times per day.

98% of texts are opened, and 90% are read within 30 minutes of receipt. Compared to emails, text messages are 134% more likely to be read.

In a survey, 63% of respondents said they would switch to a company that offered text messaging as a communication channel.

5. DO: Follow up consistently.

We talked about follow up in terms of aged leads, but follow-up should be comprehensive across categories. This includes customers who:

- Have been pre-approved

- Abandoned an application

- Had previously expressed interest at a later date

Ensure that loan officers are following up with anyone who has been pre-approved. When someone on your site starts an application but does not finish, you can:

- Automate follow-ups prompting them to finish the form.

- Manually reach out.

DON’T: Forget about prospective customers.

Some prospective customers express interest, but at a later date. For example, someone might contact you about buying a house in the next six months or so.

In these scenarios, it’s crucial to follow up at that later time, as requested. This not only ensures that the customer doesn’t forget about you, it also shows that you remember them and what they said, helping to build a connection.

In a way, this goes back to re-engaging aged leads, but doing so at the right times. In this example, if someone is planning to buy in six months, check in with them in three months, and follow up again at the six-month mark.

It’s important to note this right now, too. Now is a great time for anyone thinking of buying a house in the next few months to start shopping around.

If someone lets you know their desired time frame, be sure that loan officers are noting that and they really are following up at that time.

Ensure Mortgage Marketing ROI

Get your re-engagement strategy right and ensure marketing ROI with Verse, a mortgage industry partner since 2013.

Verse is an AI-enabled, omnichannel communication platform that fully manages lead engagement for you, primarily through SMS.

We enable your company to offer instant response, 24/7—with little to no effort from you.

Running over 250 million SMS conversations annually, Verse works for both small branch and enterprise companies.

With Verse, mortgage companies get:

- Fully-managed, compliant conversations via two-way SMS

- 24/7 coverage and instant response

- Customizable lead follow up and nurture

- Automatic lead qualification

- Compliance enablement and guidance, including TCPA, FCC, and CTIA guidelines

- Live transfer to your call center or business

We’ll help you ensure that your marketing dollars reap real results by standardizing and ensuring instant engagement and follow up for every single lead.

Inbound lead? We’ll be on it within one minute.

Lead wants to buy in six months? We follow up in six months.

Verse enables mortgage companies to grow revenue without adding headcount, and ensures that your communications are compliant, consistent, and quick. We eliminate the risks involved with compliance, and the inconsistencies involved with human follow-up.

Get started with Verse today.

Risk Mitigation for Mortgage Marketing Campaigns

While SMS is the best communication channel for mortgage companies, texting is not without its risks.

While individual loan officers may execute one-off texts and calls that they believe to be harmless, they could easily get your company in trouble due to compliance regulations—which can result in fines of up to $20,000 per offense.

In addition, officers can be inconsistent in follow up and messaging. Because individual officers cannot be controlled, automated SMS is ultimately safer.

In terms of compliance, you can ensure that every message is compliant with rules such as TCPA and FCC guidelines. Automation also standardizes messaging and follow up to ensure that every lead gets the right amount of follow up with the best messaging.

That’s why Verse is a great risk mitigation tool for mortgage companies.

For all of our partners, we gain full brand approval in every conversation design. After this, our dedicated carrier relations team reviews all messages for compliance and deliverability.

We also assist with TCR and A2P registration and monitor deliverability to make sure your messages reach your customers.

Current Verse partners at the corporate level include Fairway, Acra Lending, Embrace Home Loans, Mission Loans, The Federal Savings Bank, Capital Bank, and others.

We’d love to add your company to the list and show you the ROI that Verse can provide (16x, on average). Schedule a call with us today and engage your leads like never before.